san francisco sales tax rate

The California sales tax rate is currently 6. The current total local sales tax rate in San Francisco CA is 8625.

Tracking The San Francisco Tech Exodus Sf Citi

The current total local sales tax rate in San Francisco CA is 8625.

. The December 2020 total local sales tax rate was 8500. This is the total of state county and city sales tax rates. The December 2020 total local sales tax rate was 8500.

This is the total of state county and city sales tax rates. The current total local sales tax rate in South San Francisco CA is 9875. There is no applicable city.

The San Francisco County sales tax rate is. 94080 and 94083. The California sales tax rate is currently.

The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a. The minimum combined sales tax rate for San Francisco California is 85. 1788 rows San Francisco 8625.

The December 2020 total local sales tax rate was 9750. The California sales tax rate is currently 6. This is the total of state county and city sales tax rates.

The 85 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 225 Special tax. There is no applicable city tax. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last day.

For a more detailed breakdown of rates please. Filing Requirements from the CA Franchise Tax. California has a 6 sales tax and San Francisco County collects an.

The 2018 United States Supreme Court decision in South Dakota v. The December 2020 total local sales tax rate was 8500. The total sales tax rate in any given location can be broken down into state county city and special district rates.

This is the total of state county and city sales tax rates. An alternative sales tax rate of 9875 applies in the tax region. The minimum combined 2022 sales tax rate for San Francisco California is 863.

The minimum combined 2022 sales tax rate for South San Francisco California is. The South San Francisco California sales tax rate of 9875 applies to the following two zip codes. The California sales tax rate is currently.

The current total local sales tax rate in San Francisco County CA is 8625. This is the total of state county and city sales tax rates. The minimum combined sales tax rate for San Francisco California is 85.

How much is sales tax in San Francisco. Otherwise you will owe the annual tax rate of 884 and must file Form 100 California Franchise or Income Tax Return. This includes the rates on the state county city and special levels.

The minimum combined 2022 sales tax rate for San Francisco California is. The sales tax rate in South San Francisco California is 988. The average cumulative sales tax rate in San Francisco California is 871 with a range that spans from 863 to 988.

This includes the rates on the state county city and special. What is San Francisco sales tax rate 2020. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax.

The California state sales tax rate is currently.

California Income Tax Calculator Smartasset

House Prices In San Francisco Bay Area Experience Steep Declines From April Peak Craziness Down Year Over Year Wolf Street

Free Llc Tax Calculator How To File Llc Taxes Embroker

Coffee And Community Improvement Districts Unpacking The Mystery Of The 7 Starbucks Macchiato Salon Com

Understanding California S Sales Tax

San Francisco Adopts Major Changes To Business Taxes 2019 Articles Resources Cla Cliftonlarsonallen

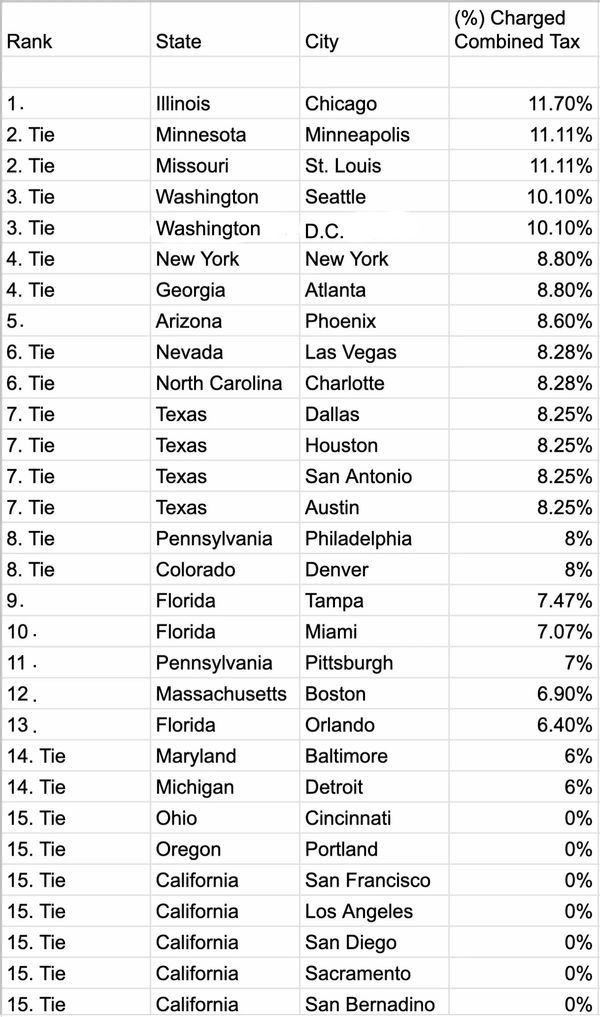

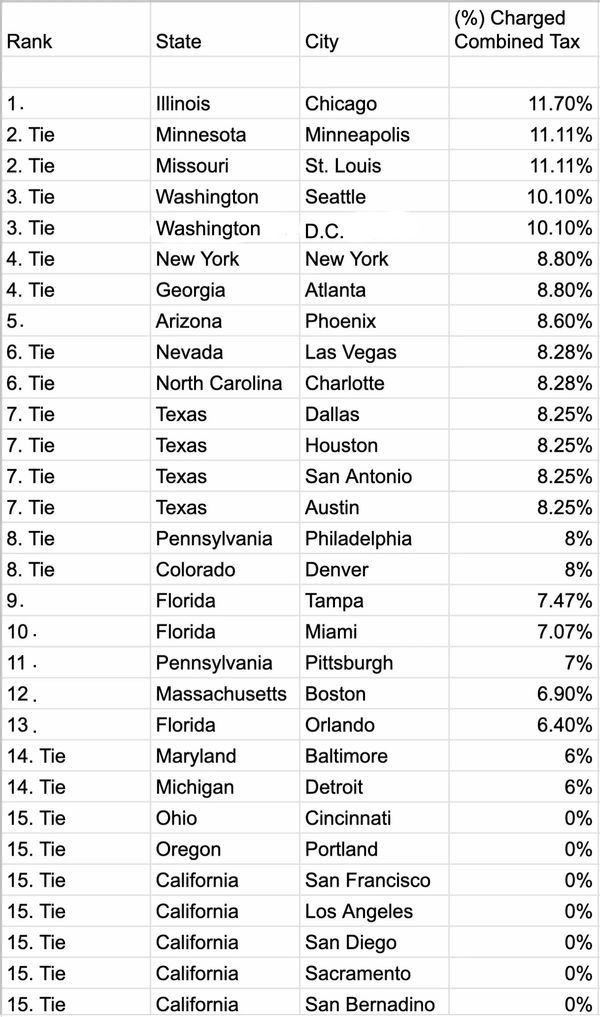

The Most And Least Tax Friendly Major Cities In America

Politifact Mostly True California S Taxes Are Among The Highest In The Nation

Study Shows Multnomah County Will Have Nation S Highest Income Taxes For High Income Earners If Preschool Measure Passes

What You Need To Know About California Sales Tax Smartasset

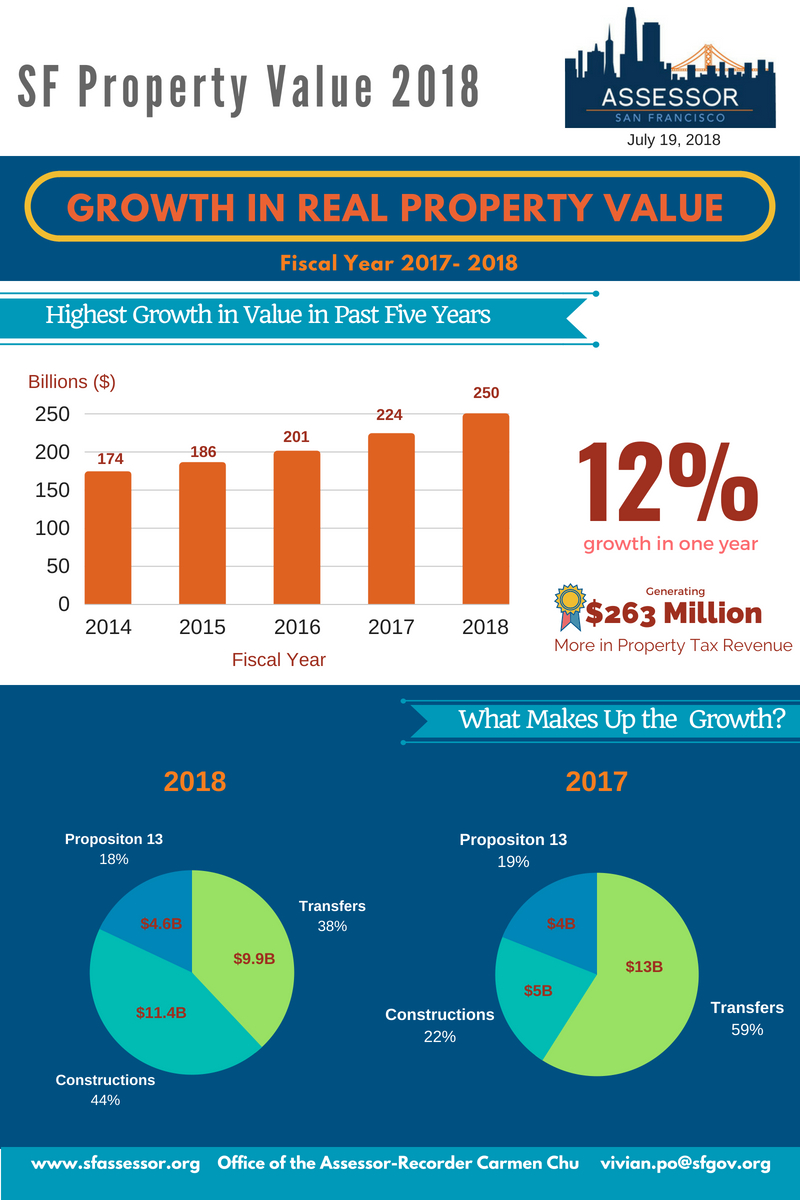

San Francisco Leads Ca Counties On Property Tax Growth Ccsf Office Of Assessor Recorder

New York Taxes Layers Of Liability Cbcny

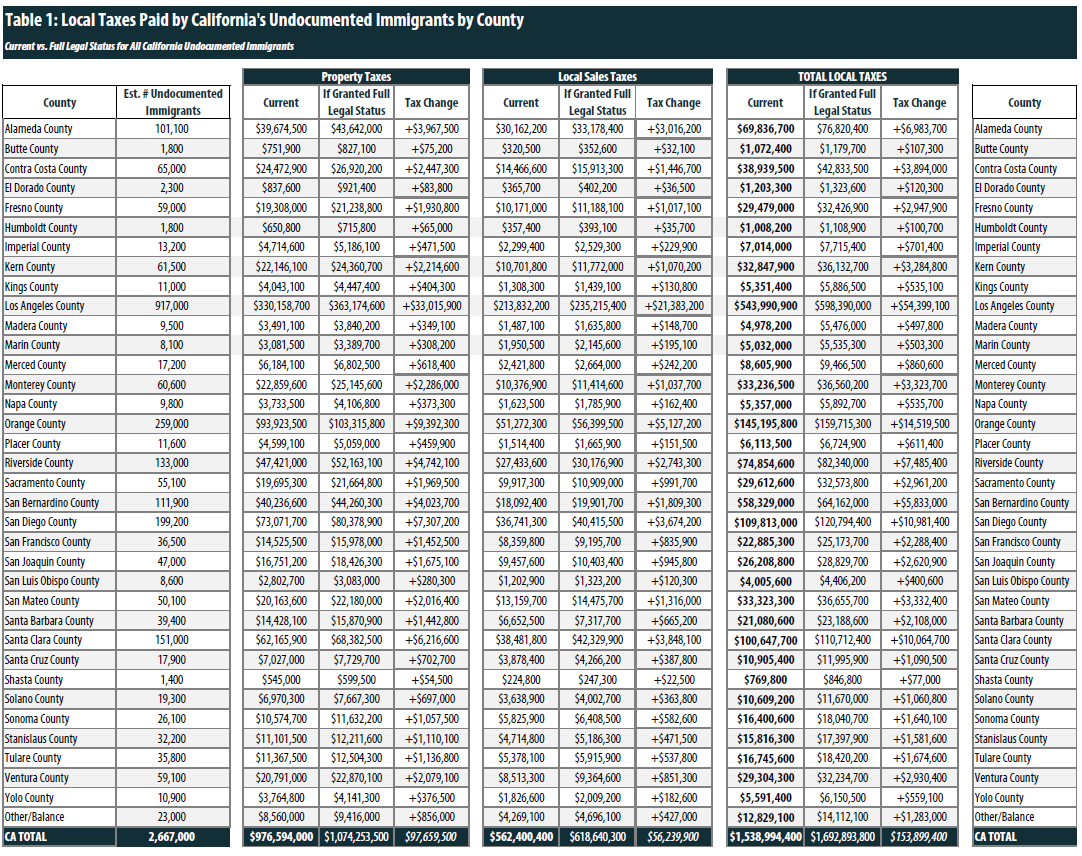

State And Local Tax Contributions Of Undocumented Californians County By County Data Itep

San Francisco S Sourcing Rules For Computing The Gross Receipts Tax

Proposed San Francisco Ballot Measure Would Double Tax Rate For City S Most Expensive Real Estate Sales

Sales Tax Rate Changes For 2022 Taxjar

Stripe Tax Automate Tax Collection On Your Stripe Transactions

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Jpr007 On Twitter And The Plot Thickens The Tax Rate Is For New York City And The Original Receipt Was For Overstaying At A Supercharger In Brooklyn Ny Https T Co Jsod3il09r Twitter